Colton, my husband and other half, is the finance guru in our household. His financial knowledge helped us save enough money for ‘the trip’, our 6 month sabbatical trip to Europe and Asia. So, I’ve asked him to share his tips to save money for travel to help get you on your way to your next big adventure!

This post may contain affiliate links. If you use these links to buy something I may earn a commission, at no additional cost to you.

One of the most common questions we get about travel is, “how much does it cost?”

While we have found that travel can be affordable, the first building block that has allowed us to travel is having all of our finances in order and making saving a priority.

If you’re wondering how we save money and stay on budget while on the road, check out Nikki’s post, 8 Simple Tips to Help You Save Money While Traveling.

Quick disclaimer: We know that not everyone has the means to save money, especially if they are working hard but not getting paid enough to pay for their basic needs. Travel is a privilege, and though money is not a finite resource, it doesn’t always come easily into our lives. We are in no way trying to minimize the reality that having the means to save money for travel is also a privilege.

Below you will find the steps and habits that we use to save for more life changing adventures.

(These saving tips apply to any goal, not just to save money for travel. Saving money is saving money, no matter how you end up spending it!)

Now, I will say that when Nikki and I began saving for travel and for ‘the trip,’ we took pretty aggressive steps to do so. All of the tips listed below are things we did to save $30k in 1.5 years, but you can take or leave any of our tips. Up to you!

Know Your Money Habits

This is by far the most important first step in taking control of your finances and finding the freedom to both spend and save.

Have a System to Keep Track of Spending

When you have multiple accounts, and even multiple people in your household finances, it can quickly become very difficult to keep track of money coming in and money going out.

The best way to learn where your money is going is to get budgeting software or an app that puts all of your banking and credit card accounts in one place. This will give you a snapshot of how money is flowing in and out of all of your accounts.

Our goal here is to have a good grip on our finances so we can maximize savings and therefore maximize our travel account!

Why Have a System to Save Money for Travel?

Having a system that lays out all of your accounts and spending is key to knowing where your money is going. You need to do this before you even try to begin budgeting.

Having a system in place that consolidates all of that information for you is going to help you see what you’re spending your money on, where you can find savings, and how much you have left over to go towards your savings account (aka travel account!).

Our Recommendation – Budget Software to Save Money for Travel

Since getting married in 2019, we have tried several different budgeting softwares, but we have landed on one that we really love.

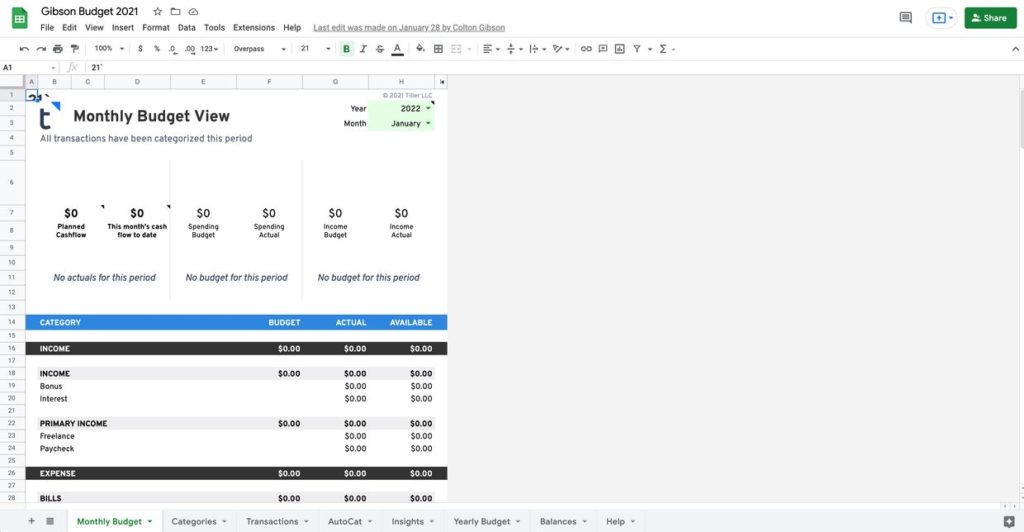

The one that we like the best is called Tiller.

Tiller is a software that links all of your bank accounts into Google Sheets or Microsoft Excel. Tiller automatically updates all of our transactions and account balances on a daily basis, then it is just up to us to categorize each of our transactions.

Once your expenses are categorized, you can clearly see where your money is being spent.

Tiller shows you your financial life in a spreadsheet, automatically updated each day.

Once you have found a software that works for you, the next step is to estimate your monthly income and expenses. After that, you can start the process of choosing where you want your money to go.

Study Your Habits

After organizing your finances into a system that you can work with and understand, you can begin analyzing your finances. Sounds RIVETING, doesn’t it?

What does this mean? Really, it just means looking at what you earn and spend when it’s all laid out in front of you. Now, you have a good grip on the state of your finances.

Take some time to notice what you’re spending your money on and the patterns and habits of your money flow.

READ ALSO:

What & How To Pack For Long Term Travel

8 Simple Tips to Help You Save Money While Traveling

Why We Decided to Quit Our Jobs and Travel

Determine Where You Can Find Savings

Get your budget set up using Tiller, then track your expenses for a month to two without changing the way you spend/save.

This allows you to have a reference for roughly how much you spend each month on various things such as groceries and eating out, gas, housing, entertainment, subscriptions, shopping, etc.

Once you have a baseline for how much you are spending, you are able to determine where you are spending more money than you would like to and change your habits.

Finding areas in which you can reduce spending can be difficult, so below are the 5 biggest categories that we have found savings.

All that extra money goes towards our next adventure!

The really hard truth about saving money is that the only way to save is by living below your means. If you haven’t been paying much attention to your finances up until this point, it might be hard to look at your money and realize you’re spending more than you actually have. If that’s the case, it may take a little adjusting to get into the habit of spending less so you can save more.

1. Eating Out and Groceries

On average we only eat out maybe one night per week. Buying groceries and cooking for ourselves is one of the ways we save the most money.

It can be hard, and you don’t need to deny yourself every time you’re craving yummy takeout. Just keep in mind how quickly food costs can add up!

2. Housing and Rent

This is where incredible savings can be found if you are willing to sacrifice a little bit.

Often, there are moves we can make to save money when it comes to housing costs, whether it be downsizing, getting a roommate, or even moving to a less expensive location.

Sometimes, you really are living very simply and still forced to pay a lot for housing. If that’s the case you’ve already found your savings.

3. Insurance

With so many insurance companies out there, it’s easy to shop around and combine your insurance to save money. This is especially true for car and home insurance.

Because its a recurring monthly expense, even small savings in this area will add up.

4. Clothing and Shopping

Asking the simple questions of want vs. need is a great way to reduce spending. Don’t hate me for saying it, but you probably don’t need half the stuff you buy on a daily basis!

You can even begin selling gently used clothing and home decor as a way to make some extra cash!

Great ways to do this online are with Facebook Marketplace and Poshmark. You can also find your local consignment shop and sell your clothes to them.

5. Subscriptions

With so many subscription services out there it is easy to sign up for a new service, barely use it, and forget to cancel.

Tracking this in a budget is the best way to evaluate and cancel unused subscriptions. (Trust me they can add up fast.) Asking friends and family to share services also keeps costs low.

Tell Your Money Where to Go

Have you ever been at the end of the month and wondered “Where did all my money go?”

I’ve certainly been in that position many times before. This simple principle helped me turn that habit around.

The idea is simply to be very intentional in telling your money where to go. Your monthly saving amount should be a line item in your budget, like any other necessary expense.

This was key to saving up enough money in 1.5 years to then do 6 months of full-time travel!

Below are a few helpful steps to telling your money where you want it to go.

Save First (Pay Yourself First)

This is the big ticket item that changed my entire view on money. SAVE FIRST! After you pay yourself first, whatever is left over at the end of the month is fair game spending money.

Have you planned to save $300 every month? Put it in your savings right away, and it will be much easier not to spend it.

The typical philosophy that many people have is to spend first, then save what may or may not be left over. If you can create a habit of always saving first, you will be amazed at how much faster your savings will grow.

After you have taken care of all your expenses and savings then you can feel the freedom to spend the extra on whatever you want!

READ ALSO:

What 6 Months of Travel to 18 Countries Cost Us

Travel Credit Cards: Our Secret To Affordable Flights All Over The World

21 Amazon Travel Essentials You Need For Long-Term Travel

Final Tips and Tricks – Save Money for Travel

Even with a great plan and good intentions, saving can be hard. So here are a few tips and tricks that I use to help us save money for travel.

1. Open a Savings Account Somewhere Else

Set up a savings account with a different institution than where your checking account is. Then, set up automatic monthly withdrawals from your checking account to your savings account (I do this every month).

If your checking account is automatically doing the saving for you, you’ll have a much easier time sticking to your monthly saving goal.

Out of sight, out of mind!

2. ‘Forget’ About Extra Money

If you have a side hustle or occasionally make some money on the side, “forget” about it.

Whenever I make some extra income that I have not already accounted for in my monthly budget, I immediately send it to my savings account. Rather than just viewing it as extra spending for the month, I see it as an extra spending for our upcoming trip!

3. Set A Goal

Set a goal for your savings and think / plan for your goal often. In our case, our passion is traveling so we are constantly finding ways to save money for travel.

In order to stay motivated to save, we often talk about our future travel plans and dreams. Setting a goal keeps us focused on saving money for travel and our next trip.

4. Don’t Look at Your Savings

Try not to look at your savings account too much. If you follow the first tip I’d call this, “set it and forget it.”

When you are regularly saving and not checking up on your savings account often, you’ll be pleasantly surprised how much you have saved the next time you look.

I hope that this guide has been helpful in giving you the tools you need to save money for travel. for you on your journey to funding your next adventure!

4 Comments